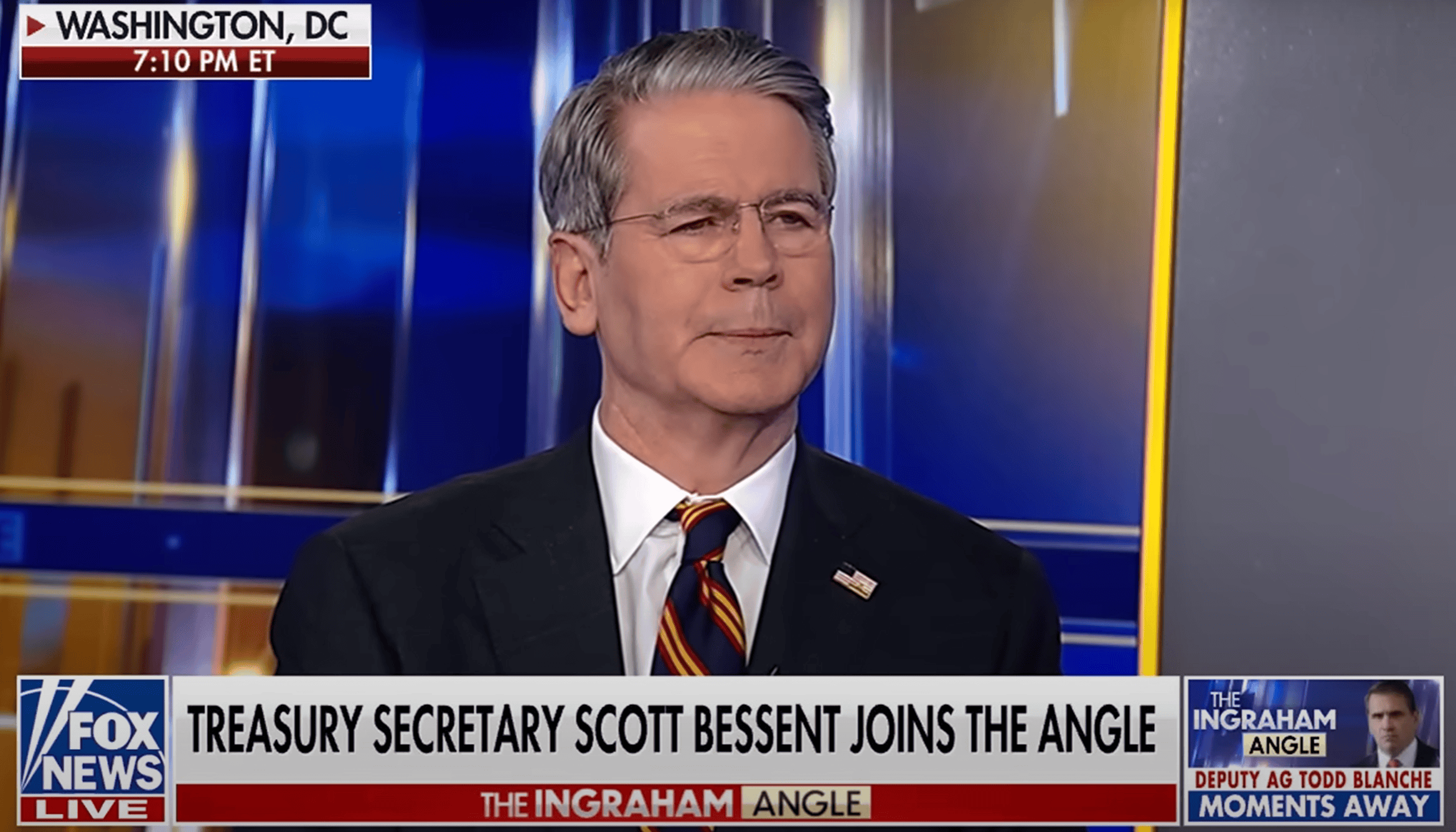

After President Donald Trump announced the 3-month extension of the trade truce on the supposed tariff deadline of August 12, the global trade market breathed a sigh of relief as the tension wound down. But the future outlook of the global economy remains unclear as the economic friction continues between major powers around the world. During the interview with Fox News on August 20, US Treasury Secretary Scott Bessent said that the Trump administration is “very happy” about the current situation.

Information on us-china tariff from the interview

In the interview, Benssent listed a few tariffs imposed by the US including the ones from the first term of President Trump, the recent fentanyl tax, and the base line tariff, as well as the countermeasure from China, claiming that “the status quo is working pretty well.” Then he proceeds to mention that China has become the largest source of tariff income for US.

Many speculate that this gesture of the Trump administration is merely an attempt to ensure stability ahead of the new November trade truce deadline, instead of a peace offering on more equitable trade deals. Immediately after this part of the interview, Bessent emphaszied the importance of bringing manufacturing back to the U.S. to enhance economic security and independence from adversaries. He also stated that the ongoing strategy aims to reduce reliance on foreign nations for critical supplies, particularly in technology and pharmaceuticals, and warned that failure to address the issues of secondary industry and rare-earth materials independence by 2029 could jeopardize U.S. economic stability and competitiveness.

Future outlook of trade deals & global economy

The future outlook of the US-China trade war remains uncertain, characterized by temporary truces, high tariffs, and ongoing economic tension. Despite the extension of the tariff truce, deeper structural issues persist between the two economic powerhouses.

While this truce reduced US tariffs on Chinese goods to 30% from a peak of 145% and Chinese tariffs to 10% from 125%, both nations continue to accuse each other of violating the terms of trade pacts, maintaining high trade barriers, using non-tariff countermeasures, and putting forward new tit-for-tat tariffs.

Critically, this trade conflict has contributed to significant global economic repercussions, including the disruption of supply chains, decreased bilateral trade volumes, and heightened uncertainty for businesses worldwide. For instance, Chinese exports to the US plummeted by 34.5% within months of the tariff escalations earlier in 2025, underscoring the damaging economic impact of this ongoing rivalry.

Efforts toward resolution, such as recent negotiations between trade representatives and negotiators in London and Stockholm, have shown some promise, with both sides reportedly reaching a framework agreement. Despite this, no formal deal is yet in place, leaving businesses and governments grappling with a highly unpredictable landscape. The expiration of the current truce in November 2025 will likely be a pivotal moment, potentially escalating tensions further if new agreements fail to materialize.

Key unresolved concerns, such as trade imbalances, intellectual property rights, technological competition, national security fears, not to mention the recent concerns of increased Chinese purchases of Russian oil, which make it more involved in the current geopolitical conflict between Russian and Ukraine, all suggest that the rivalry between China and the US will not recede any time soon. As a result, the future trajectory of the trade war appears tied to broader political and strategic priorities beyond purely economic concerns.